Navigating the complexities of Social Security benefits can feel daunting, but understanding how these benefits work is crucial for a secure retirement. This guide unravels the intricacies of Social Security, offering insights into maximizing your payouts and integrating them seamlessly into your overall financial plan. From eligibility requirements to strategic claiming strategies, we’ll explore various scenarios to help you make informed decisions about your future financial well-being.

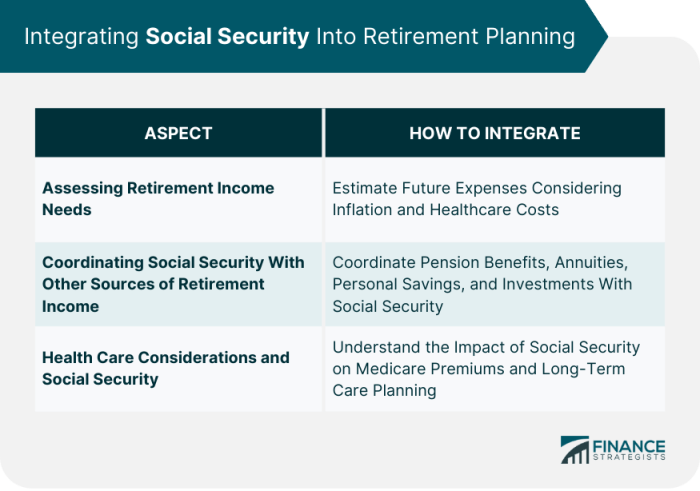

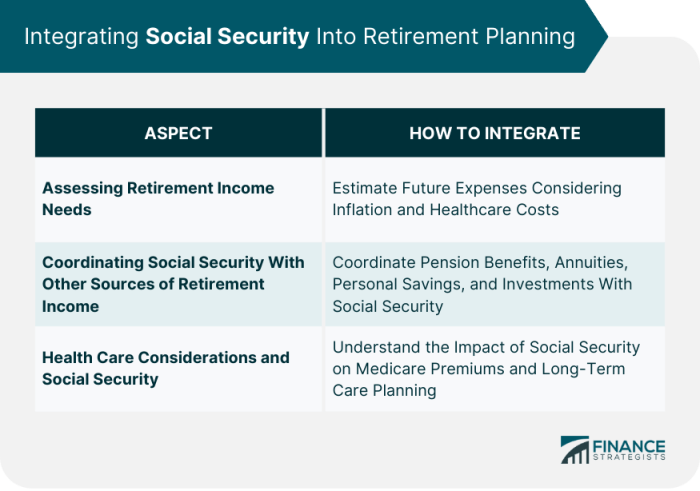

We’ll delve into the different types of Social Security benefits, the impact of life events on your eligibility, and how to coordinate your Social Security benefits with other retirement income sources like pensions and 401(k)s. We’ll also address the importance of early retirement planning and provide practical strategies for maximizing your savings and building a comprehensive retirement plan that aligns with your individual needs and goals.

Retirement Planning and Savings Strategies

Planning for a comfortable retirement requires a proactive approach, starting well in advance of your desired retirement date. The earlier you begin saving, the more time your investments have to grow, benefiting significantly from the power of compounding. Understanding various savings vehicles and their tax implications is crucial for maximizing your retirement funds.

The Importance of Early Retirement Savings

Starting to save for retirement early offers substantial advantages. The principle of compound interest allows your initial investments to generate earnings, which then earn further returns over time. This exponential growth significantly increases your retirement nest egg compared to starting later. For example, investing $1000 annually at age 25 versus age 35, assuming a 7% annual return, results in a considerably larger sum by retirement age.

The longer timeframe allows for greater accumulation, mitigating the need for drastically higher contributions later in life.

Retirement Savings Vehicles

Several vehicles exist to facilitate retirement savings, each with unique features.(k) plans: Offered by many employers, these plans allow pre-tax contributions, reducing your current taxable income. Employer matching contributions can significantly boost your savings. Withdrawals are typically taxed in retirement.Traditional IRAs: Individual Retirement Accounts allow pre-tax contributions, similar to 401(k)s, offering tax advantages during your working years.

However, withdrawals are taxed in retirement. Contribution limits apply.Roth IRAs: These accounts allow after-tax contributions, meaning you pay taxes now but withdrawals in retirement are tax-free. This is particularly beneficial if you anticipate being in a higher tax bracket in retirement. Contribution limits also apply.

Strategies for Maximizing Retirement Savings Contributions

Maximizing contributions involves several key strategies. Automate your savings by setting up automatic transfers from your checking account to your retirement accounts. Increase your contribution percentage gradually over time, as your income increases. Take advantage of employer matching contributions in your 401(k) plan – it’s essentially free money. Consider making additional contributions beyond the annual limits if your financial situation allows.

Regularly review and adjust your investment strategy to ensure it aligns with your goals and risk tolerance.

Tax Implications of Retirement Savings Plans

The tax implications vary depending on the chosen plan. Traditional 401(k)s and IRAs offer tax deductions on contributions, reducing your current taxable income. However, withdrawals are taxed in retirement. Roth IRAs involve paying taxes upfront, but withdrawals are tax-free in retirement. Understanding these implications is vital for optimizing your tax efficiency throughout your life.

Consult with a tax advisor for personalized guidance.

Steps for Building a Comprehensive Retirement Plan

Building a comprehensive retirement plan requires a structured approach.

- Determine your retirement goals: Define your desired lifestyle and estimate your retirement expenses.

- Calculate your savings needs: Estimate how much you’ll need to save to achieve your goals.

- Choose appropriate savings vehicles: Select plans that align with your tax situation and risk tolerance.

- Develop an investment strategy: Diversify your investments across different asset classes.

- Regularly monitor and adjust your plan: Review your progress periodically and make adjustments as needed.

- Seek professional advice: Consult with a financial advisor for personalized guidance.

Illustrating Retirement Income Scenarios

Understanding different retirement income scenarios is crucial for effective financial planning. The level of financial security in retirement is significantly impacted by the diversity and reliability of income streams. Let’s examine two contrasting scenarios to illustrate this point.

Retirement Scenario: Heavy Reliance on Social Security

This scenario depicts Maria, a 67-year-old retiree whose primary income source is her Social Security benefits. She worked as a teacher for 30 years, contributing consistently to the system. Her monthly Social Security check provides her with approximately $1,800. Maria lives modestly in a smaller home she owned outright, minimizing her housing costs. She enjoys spending time with her grandchildren and engages in low-cost hobbies like gardening and knitting.

However, Maria faces several challenges. Unexpected medical expenses could quickly deplete her savings. Inflation erodes the purchasing power of her fixed income, making it harder to maintain her lifestyle over time. She has limited resources for unforeseen events or emergencies. This highlights the vulnerability of relying solely on a single income stream, especially one susceptible to inflation.

Retirement Scenario: Diversified Retirement Income

In contrast, consider John, also 67, who enjoys a more secure retirement. While his Social Security benefits contribute approximately $2,200 monthly, he also receives a pension from his previous employer, adding another $1,500. He further supplements his income through investments and rental properties, generating an additional $1,000 monthly. John and his wife live comfortably in a paid-off home and can afford occasional travel and leisure activities.

They have a substantial emergency fund to cover unforeseen expenses, and their diversified income streams provide a safety net against inflation and unexpected events. Their financial security allows them to enjoy a more fulfilling and less stressful retirement.

Visual Representation of Retirement Income Scenarios

Imagine two bar graphs side-by-side. The first bar graph, representing Maria’s income, shows a single, relatively short bar representing her Social Security benefits ($1800). Below this bar, a smaller bar represents her limited savings. The second bar graph, illustrating John’s income, displays several taller bars of varying heights: one for Social Security ($2200), one for his pension ($1500), and another for his investments and rental income ($1000).

A significantly larger bar representing his savings and emergency fund sits below these income bars. The visual difference clearly highlights the greater financial security and resilience provided by diversified income sources. The contrast in the size of the “savings” bars emphasizes the impact of diversified income on financial stability.

Planning for retirement with Social Security benefits requires careful consideration of various factors, from your personal circumstances to potential economic shifts. By understanding the intricacies of the system and proactively developing a well-defined strategy, you can significantly enhance your financial security in retirement. This guide provides a foundation for making informed decisions, ensuring a comfortable and financially sound future.

Remember to consult with a financial advisor for personalized guidance tailored to your specific situation.

Popular Questions

What happens to my Social Security benefits if I continue working after retirement age?

Your benefits may be affected depending on your age and earnings. There are annual earnings limits, and exceeding them could reduce your benefits for some months. However, this doesn’t affect your future benefits after you reach full retirement age.

Can I get Social Security benefits if I’ve never worked?

Generally, no. Social Security benefits are primarily based on your own earnings history or that of a spouse or parent. However, there might be limited exceptions, such as benefits for children or disabled adults of qualifying individuals.

How often are Social Security benefits adjusted?

Benefits are adjusted annually based on the cost of living, using the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W).

What if I divorce before I’m eligible for Social Security?

You may still be eligible for spousal benefits based on your ex-spouse’s earnings record, provided you were married for at least 10 years and are currently unmarried.