Securing a comfortable retirement requires careful planning, and a crucial element of this planning involves developing a sound retirement withdrawal strategy. This isn’t simply about accessing your savings; it’s about strategically managing your funds to ensure they last throughout your retirement years, accounting for inflation, taxes, and unforeseen circumstances. Understanding various withdrawal methods, their associated risks and benefits, and the impact of factors like inflation and longevity are key to building a sustainable retirement income plan.

This guide explores the multifaceted world of retirement withdrawals, examining the 4% rule and its alternatives, the role of asset allocation and diversification, and the significant tax implications involved. We’ll delve into strategies for mitigating risks, such as inflation and longevity, and offer practical advice to help you create a personalized plan tailored to your specific financial situation and goals.

The ultimate aim is to empower you with the knowledge to confidently navigate the complexities of retirement income and enjoy a financially secure future.

Understanding Retirement Income Needs

Planning for a comfortable retirement hinges on accurately assessing your future income requirements. This involves considering various factors and developing a realistic budget that accounts for both essential and discretionary spending. Failing to adequately plan can lead to significant financial hardship in retirement.

Factors Influencing Retirement Income Requirements

Several key factors significantly impact the amount of income needed during retirement. These include your desired lifestyle, current age and health, anticipated lifespan, inflation, and unexpected expenses. For instance, someone planning an active travel-filled retirement will require a substantially higher income than someone who anticipates a more sedentary lifestyle. Similarly, unexpected medical expenses can dramatically alter retirement spending needs.

Health conditions can impact both the need for medical care and the ability to maintain a previous employment income level.

Essential Versus Discretionary Retirement Spending

Distinguishing between essential and discretionary spending is crucial for effective retirement planning. Essential expenses are those necessary for survival and basic well-being, such as housing, food, utilities, healthcare, and transportation. Discretionary spending encompasses non-essential items like travel, entertainment, dining out, and hobbies. While discretionary spending enhances quality of life, it’s vital to prioritize essential expenses when budgeting for retirement.

A detailed budget that clearly separates these categories will help prioritize essential spending and allow for flexible management of discretionary spending during periods of financial constraint.

Calculating Estimated Retirement Income Needs

Accurately estimating retirement income needs requires a methodical approach. Begin by creating a detailed budget reflecting your current spending habits, separating essential and discretionary expenses. Next, project these expenses into the future, accounting for inflation. A common method involves using an inflation rate projection, usually provided by financial institutions or government sources, to increase your current expenses year by year.

For example, if your current annual essential expenses are $40,000 and you project a 3% annual inflation rate, your essential expenses in 10 years would be approximately $53,603 ($40,0001.03 10). Remember to adjust this projection periodically to reflect changes in your lifestyle or economic conditions.

Comparison of Retirement Income Sources

Several sources can contribute to your retirement income. It’s essential to understand the strengths and limitations of each.

| Income Source | Description | Advantages | Disadvantages |

|---|---|---|---|

| Social Security | Government-provided retirement benefits | Guaranteed income stream, relatively predictable | Benefit amount may not be sufficient for all needs, subject to government changes |

| Pensions | Defined benefit plans from previous employers | Guaranteed income stream, potentially substantial | Not common in many modern employment structures |

| Investments (401(k), IRAs) | Retirement savings accounts | Potential for significant growth, tax advantages | Subject to market fluctuations, requires careful management |

| Part-time work/Consulting | Supplemental income during retirement | Flexibility, potential for additional income | May not be feasible for all retirees, requires ongoing effort |

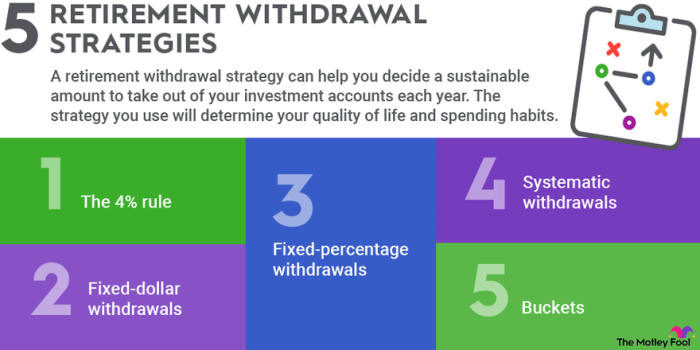

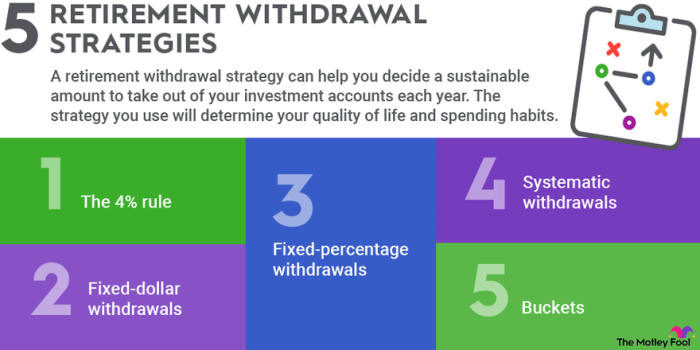

Retirement Withdrawal Strategies

Planning how you’ll access your retirement savings is crucial for ensuring a comfortable and financially secure retirement. A well-defined withdrawal strategy considers factors like your lifespan, investment performance, and desired lifestyle. Understanding different approaches allows you to choose the method best suited to your individual circumstances and risk tolerance.

The 4% Rule and its Underlying Assumptions

The 4% rule is a popular guideline suggesting that retirees can safely withdraw 4% of their retirement portfolio annually, adjusting for inflation each year. This rule assumes a diversified portfolio, a 30-year retirement timeframe, and a relatively stable investment market. The underlying assumption is that the remaining 96% will continue to grow at a rate sufficient to outpace inflation and provide a sustainable income stream.

It’s important to note that this rule is a heuristic, not a guaranteed formula.

Limitations and Potential Risks of the 4% Rule

The 4% rule, while simple and intuitive, has limitations. Its reliance on historical market data might not accurately reflect future market volatility. Unexpected economic downturns or prolonged periods of low returns could deplete the portfolio faster than anticipated. Furthermore, individual circumstances, such as unexpected healthcare costs or longevity, can significantly impact the viability of this strategy. The rule also doesn’t account for differing risk tolerances; some individuals may be more comfortable with a lower withdrawal rate, while others might consider a higher rate, depending on their individual circumstances.

Alternative Withdrawal Strategies: Variable Percentage and Fixed-Dollar Methods

Several alternatives to the 4% rule offer greater flexibility and risk management. The variable percentage withdrawal method adjusts the withdrawal rate annually based on portfolio performance. In years of strong market performance, withdrawals can be higher, while in down years, they can be lower or even zero, helping to protect the principal. Conversely, the fixed-dollar withdrawal method involves withdrawing a fixed dollar amount each year, regardless of market fluctuations.

This provides predictable income but may lead to faster portfolio depletion if returns are consistently low.

Comparison of Withdrawal Strategies

| Withdrawal Strategy | Advantages | Disadvantages |

|---|---|---|

| 4% Rule | Simple, easy to understand | Rigid, susceptible to market downturns, doesn’t account for individual circumstances |

| Variable Percentage Withdrawal | Flexible, adapts to market fluctuations, helps preserve capital | More complex to manage, requires more market knowledge |

| Fixed-Dollar Withdrawal | Predictable income, simple to implement | Can deplete portfolio faster in down markets, less flexible |

Managing Investment Portfolios in Retirement

Successfully navigating retirement requires a well-structured and actively managed investment portfolio. This involves careful consideration of asset allocation, diversification, and adjustments based on both market fluctuations and personal risk tolerance. A proactive approach to portfolio management is crucial for ensuring a consistent and sustainable income stream throughout retirement.

Asset Allocation’s Importance in Retirement Portfolio Management

Asset allocation is the cornerstone of effective retirement portfolio management. It refers to the strategic distribution of your investments across different asset classes, such as stocks, bonds, real estate, and cash. The ideal allocation depends on your individual circumstances, including your age, risk tolerance, and retirement goals. A younger retiree with a longer time horizon might tolerate a higher proportion of stocks, aiming for higher growth potential, while an older retiree might prefer a more conservative allocation with a larger percentage in bonds to preserve capital.

A well-defined asset allocation strategy helps balance risk and return, aiming to maximize returns while minimizing the potential for significant losses. Without a carefully considered allocation, retirees risk jeopardizing their financial security.

Diversification’s Role in Mitigating Investment Risk During Retirement

Diversification is a crucial risk management technique that involves spreading investments across various asset classes and sectors. By diversifying, you reduce the impact of poor performance in any single investment. For example, if the stock market experiences a downturn, the losses in your stock portfolio might be offset by gains in your bond or real estate holdings. This principle applies across different geographic regions as well.

International diversification can help to mitigate risks associated with economic downturns in a specific country or region. Effective diversification isn’t simply about holding a large number of investments; it’s about strategically selecting investments that are not highly correlated with each other.

Strategies for Adjusting Asset Allocation Based on Market Conditions and Individual Risk Tolerance

Regularly reviewing and adjusting your asset allocation is essential to maintain a balance between risk and return. Market conditions are constantly changing, and your personal circumstances may also evolve over time. For example, a period of sustained market growth might prompt a slight shift towards more conservative investments to protect gains. Conversely, a prolonged period of low returns might necessitate a reassessment and a potential increase in higher-growth investments, depending on your risk tolerance and time horizon.

It’s advisable to consult with a financial advisor to determine the optimal adjustments based on your individual needs and the current market environment. A well-defined strategy should incorporate a plan for rebalancing the portfolio periodically to maintain the target asset allocation.

Common Investment Options Suitable for Retirement Portfolios

Understanding the various investment options available is critical for building a well-diversified retirement portfolio. Each option carries a unique risk-reward profile.

- Stocks (Equities): Offer high growth potential but also carry significant risk. Returns can fluctuate significantly based on market conditions and company performance. Examples include individual company stocks and stock mutual funds or ETFs.

- Bonds (Fixed Income): Generally considered less risky than stocks, providing a steady stream of income through interest payments. However, their returns are typically lower than stocks. Examples include government bonds, corporate bonds, and bond mutual funds.

- Real Estate: Can provide both income (through rental properties) and appreciation in value. However, it is illiquid and can be subject to market fluctuations and property-specific risks. Examples include owning rental properties or investing in real estate investment trusts (REITs).

- Cash and Cash Equivalents: The least risky option, offering stability and liquidity. However, returns are typically low and may not keep pace with inflation. Examples include savings accounts, money market accounts, and certificates of deposit (CDs).

Tax Implications of Retirement Withdrawals

Understanding the tax implications of your retirement withdrawals is crucial for maximizing your after-tax income in retirement. Different retirement accounts are taxed differently, and strategic planning can significantly impact your overall tax liability. This section will explore the tax treatment of various retirement accounts and offer strategies for minimizing your tax burden.

Tax Implications of Different Retirement Accounts

Withdrawals from traditional 401(k)s and IRAs are taxed as ordinary income. This means the withdrawn amount is added to your other income and taxed at your applicable marginal tax rate. In contrast, withdrawals from Roth IRAs are generally tax-free, provided the conditions for qualified distributions are met (contributions were made after tax, and the account has been open for at least five years).

Early withdrawals from both traditional and Roth accounts may also be subject to additional penalties, unless specific exceptions apply. For example, early withdrawals from a 401(k) before age 59 1/2 are generally subject to a 10% penalty, plus ordinary income tax, unless an exception like hardship applies. The specific rules and regulations governing these exceptions are complex and should be carefully reviewed with a financial advisor or tax professional.

Strategies for Minimizing Taxes on Retirement Income

Several strategies can help minimize the tax burden on your retirement income. One key strategy is to diversify your retirement accounts, utilizing both traditional and Roth accounts to create flexibility in your withdrawal strategy. This allows you to strategically withdraw from accounts that minimize your overall tax liability in a given year. Another important strategy is to carefully consider your withdrawal timing.

For example, withdrawing less in years with lower income might allow you to remain in a lower tax bracket. Furthermore, maximizing tax-advantaged accounts such as Health Savings Accounts (HSAs) can help reduce your taxable income in retirement by paying for healthcare expenses tax-free. Understanding your specific tax bracket and projections is crucial for optimizing this aspect of your retirement planning.

Tax-Efficient Withdrawal Strategies for Various Income Levels

Tax-efficient withdrawal strategies depend significantly on an individual’s income level and tax bracket. For individuals in lower tax brackets, it may be more beneficial to withdraw from traditional retirement accounts, as the tax burden will be lower. Conversely, individuals in higher tax brackets might find it advantageous to prioritize withdrawals from Roth IRAs to avoid paying taxes on those funds.

For those with a mix of traditional and Roth accounts, a blended approach might be optimal, balancing withdrawals from both to minimize the overall tax liability throughout retirement. The optimal strategy is highly personalized and requires a comprehensive understanding of one’s financial situation and future tax projections.

Hypothetical Scenario: Impact of Withdrawal Strategies on Tax Liability

Let’s consider a hypothetical scenario. Suppose Maria has $500,000 in a traditional IRA and $200,000 in a Roth IRA. If Maria is in a high tax bracket and needs $50,000 annually, withdrawing entirely from her traditional IRA would result in a significant tax liability. However, by strategically withdrawing $25,000 from each account, she can reduce her immediate tax liability while still accessing the funds she needs.

This strategy is more tax-efficient than solely withdrawing from the traditional IRA. Furthermore, if Maria anticipates her income decreasing in future years, she might choose to withdraw more from the Roth IRA in those years to maintain a lower overall tax burden over her retirement. This example highlights the importance of a personalized strategy tailored to an individual’s specific financial circumstances and future projections.

Inflation and its Impact on Retirement Withdrawals

Inflation silently erodes the purchasing power of money over time. This is a crucial consideration for retirees, as it directly affects the longevity and quality of their retirement income. Understanding how inflation impacts retirement withdrawals and employing strategies to mitigate its effects is vital for ensuring a comfortable and secure retirement.Inflation reduces the value of your savings. A dollar today will not buy the same amount of goods and services in the future due to rising prices.

This means that a fixed withdrawal amount from your retirement savings will buy less over time, diminishing your standard of living. The impact is particularly significant over longer retirement periods, where the cumulative effect of inflation can substantially reduce the real value of your nest egg.

Strategies for Protecting Retirement Income from Inflation

Protecting retirement income from inflation requires a proactive approach involving diversified investments and strategic withdrawal planning. Ignoring inflation’s impact can lead to a significant reduction in your purchasing power over time. Several strategies can help to mitigate this risk.One effective strategy is to invest a portion of your retirement savings in assets that historically have outpaced inflation, such as stocks and inflation-protected securities (TIPS).

Stocks, representing ownership in companies, tend to grow in value over the long term, often exceeding inflation rates. TIPS, issued by the government, adjust their principal value to account for inflation, providing a hedge against rising prices. A balanced portfolio incorporating both growth and inflation-protected assets can provide a more robust defense against inflation’s erosive effects. For example, a portfolio with 60% stocks and 40% TIPS might provide a better return than a portfolio entirely invested in bonds during periods of high inflation.Another key strategy is to regularly adjust your withdrawal amounts to account for inflation.

This ensures that your withdrawals maintain their purchasing power over time. This can be achieved by increasing your withdrawals annually by a percentage that reflects the expected inflation rate. For instance, if the inflation rate is projected to be 3%, you would increase your annual withdrawals by 3% each year. This method helps to maintain your real purchasing power and prevent a decline in your standard of living.

This method requires careful monitoring of inflation rates and diligent adjustment of withdrawals, but it is a valuable tool in managing the effects of inflation on your retirement funds.

Adjusting Withdrawal Amounts to Account for Inflation

Determining the appropriate adjustment to your withdrawal amount requires careful consideration of several factors. Simply increasing your withdrawals by the inflation rate each year might not be sufficient if your investment returns do not keep pace with inflation. Therefore, a more comprehensive approach is needed.One method involves calculating the real rate of return on your investments. This is done by subtracting the inflation rate from the nominal rate of return.

If your investments earn a nominal return of 6% and inflation is 3%, your real rate of return is 3%. Based on this real rate of return, you can then adjust your withdrawal amount to maintain your purchasing power.Another approach involves using a more sophisticated financial model that incorporates factors such as expected investment returns, longevity, and risk tolerance.

These models can provide a more personalized and comprehensive plan for adjusting withdrawal amounts to account for inflation. Financial advisors often utilize such models to create tailored retirement withdrawal strategies.

Long-Term Effects of Inflation on Withdrawal Strategies

A fixed-dollar withdrawal strategy, where the withdrawal amount remains constant each year, will inevitably lead to a decline in purchasing power over time. Consider an example: if a retiree withdraws $50,000 annually with a 3% annual inflation rate, the real value of that $50,000 will decrease each year. After 10 years, the purchasing power of that $50,000 would be significantly less than it was initially.

Conversely, an inflation-adjusted withdrawal strategy, where the withdrawal amount is increased annually to account for inflation, helps to maintain the purchasing power of the withdrawals.Using the same example, if the retiree adjusted their withdrawals by 3% annually, their withdrawals would increase each year, maintaining a consistent purchasing power. While the nominal amount withdrawn increases, the real value of those withdrawals would remain relatively constant.

This illustrates the critical long-term impact of considering inflation when planning retirement withdrawals. A fixed withdrawal plan risks significant reductions in living standards as prices increase, whereas an inflation-adjusted plan aims to preserve the real value of retirement income.

Successfully navigating retirement withdrawals requires a holistic approach that considers individual needs, risk tolerance, and market conditions. While the 4% rule serves as a useful benchmark, a more personalized strategy, factoring in inflation, taxes, and longevity risk, is often necessary. By carefully considering asset allocation, diversification, and tax-efficient withdrawal techniques, retirees can significantly enhance their chances of maintaining a comfortable lifestyle throughout their retirement years.

Proactive planning and regular review of your withdrawal strategy are crucial to adapting to changing circumstances and ensuring long-term financial security.

Essential Questionnaire

What is the sequence of withdrawals (Systematic Withdrawal Plan)?

A systematic withdrawal plan (SWP) involves regularly withdrawing a fixed amount or percentage from your investments. This provides a predictable income stream but may expose you to sequence of returns risk if markets perform poorly during early withdrawal years.

How do I adjust my withdrawal strategy for unexpected expenses?

Build an emergency fund separate from your retirement savings. If unexpected expenses arise, draw from this fund first. If necessary, re-evaluate your withdrawal strategy, possibly reducing withdrawals temporarily or adjusting your spending plan.

What are the tax implications of early withdrawals from retirement accounts?

Early withdrawals from traditional retirement accounts (like 401(k)s and IRAs) are typically subject to income tax and potentially a 10% early withdrawal penalty. Roth IRAs generally allow tax-free withdrawals of contributions (but not earnings) before age 59 1/2.

Can I use a financial advisor to help me develop a retirement withdrawal strategy?

Yes, a financial advisor can provide personalized guidance based on your specific circumstances and goals. They can help you assess your risk tolerance, develop a suitable asset allocation strategy, and create a comprehensive retirement withdrawal plan.