Planning for retirement can feel daunting, but with the right strategies, securing a comfortable future is achievable. This guide provides a comprehensive overview of retirement savings, encompassing various investment vehicles, planning timelines, and debt management techniques. We’ll explore how to set realistic goals, diversify your investments, and navigate the complexities of retirement planning to build a financially secure future.

From understanding your retirement needs and associated costs to navigating the intricacies of different retirement accounts like 401(k)s and IRAs, this guide equips you with the knowledge to make informed decisions. We’ll delve into effective investment strategies tailored to different risk tolerances and timelines, ensuring your savings grow steadily and sustainably. We also address crucial aspects like managing debt and creating a realistic budget, laying a solid foundation for your retirement journey.

Retirement Savings Vehicles

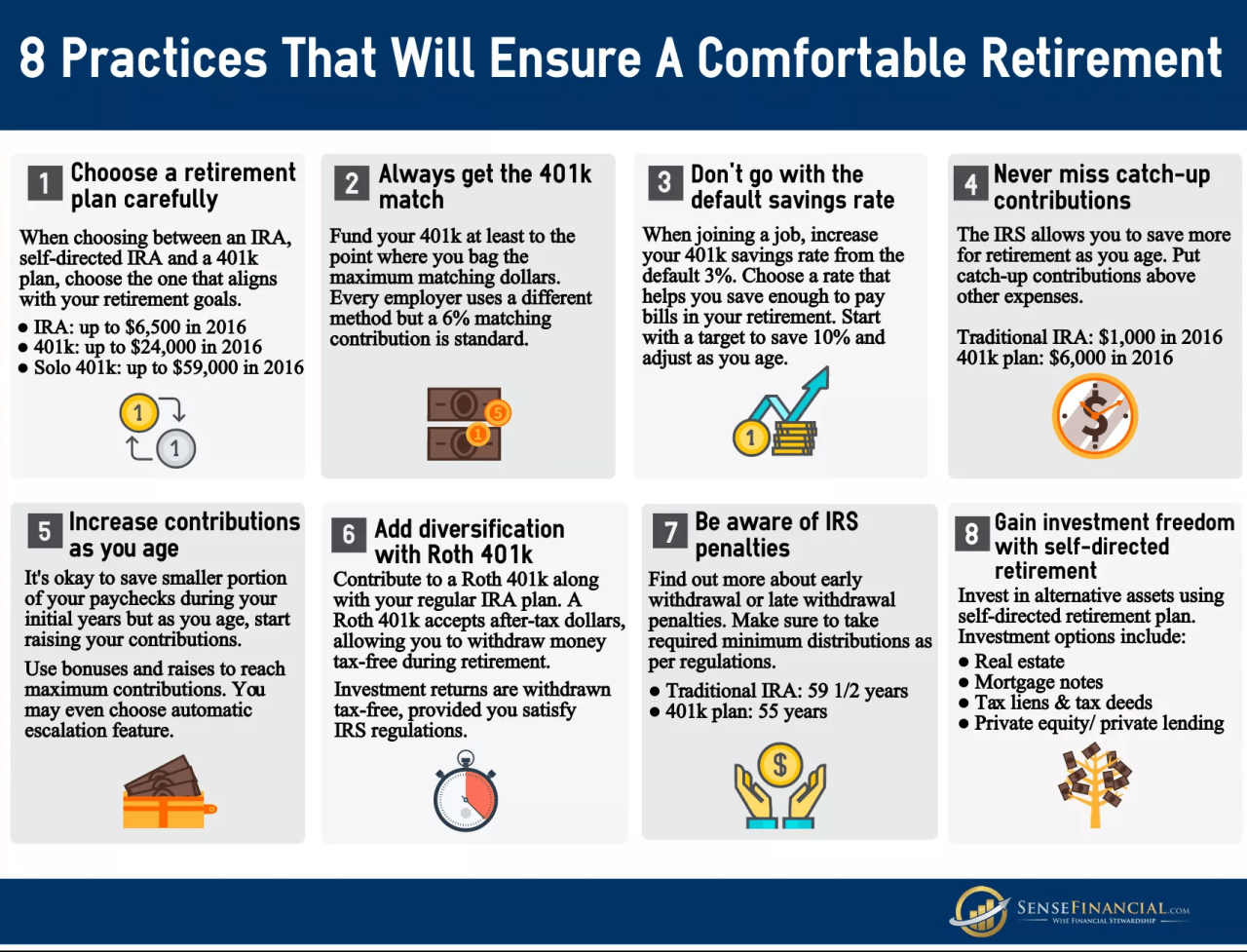

Choosing the right retirement savings vehicle is crucial for securing your financial future. Understanding the differences between various accounts, their tax implications, and contribution strategies will help you build a robust retirement nest egg. This section will explore the key features of common retirement savings accounts and offer strategies for maximizing your contributions.

Types of Retirement Savings Accounts

Several retirement savings accounts offer distinct advantages and disadvantages. The three most common are 401(k)s, traditional IRAs, and Roth IRAs. Each account type has unique tax implications that significantly impact your overall retirement savings strategy. Careful consideration of these differences is essential for making informed decisions aligned with your individual financial circumstances and long-term goals.

401(k) Plans

(k) plans are employer-sponsored retirement savings plans. Contributions are typically made through payroll deductions, and employers often offer matching contributions, essentially providing free money towards your retirement. Pre-tax contributions reduce your taxable income in the present year, resulting in lower taxes now, but your withdrawals in retirement are taxed as ordinary income. The contribution limits are set annually by the IRS.

For example, in 2023, the maximum contribution limit for employees under age 50 was $23,000.

Traditional IRAs

Traditional Individual Retirement Accounts (IRAs) allow individuals to contribute pre-tax dollars, reducing their current taxable income. Similar to 401(k)s, withdrawals in retirement are taxed as ordinary income. However, unlike 401(k)s, IRAs offer greater investment flexibility. Contribution limits are also set annually by the IRS and are independent of employer-sponsored plans. For example, in 2023, the maximum contribution limit for individuals under age 50 was $6,500.

Roth IRAs

Roth IRAs differ significantly from traditional IRAs and 401(k)s in that contributions are made after tax. This means your contributions are not tax-deductible in the present year. However, the significant advantage is that withdrawals in retirement are tax-free, providing a substantial tax benefit in the long run. Similar contribution limits to traditional IRAs apply, with the same yearly adjustments made by the IRS.

This makes Roth IRAs particularly attractive for individuals who anticipate being in a higher tax bracket in retirement than they are currently.

Maximizing Retirement Account Contributions

Strategies for maximizing contributions involve understanding contribution limits, employer matching programs, and consistent contributions. Many employers offer matching contributions up to a certain percentage of your salary, essentially doubling your investment. For instance, an employer might match 50% of your contributions up to 6% of your salary. This represents a significant opportunity to boost your retirement savings.

Automatic payroll deductions can also facilitate consistent contributions and help you stay on track to meet your retirement goals. Regularly reviewing and adjusting your contribution rate can help ensure you are making the most of these opportunities.

Employer-Sponsored Retirement Plans and Matching Contributions

Employer-sponsored plans, like 401(k)s, often include matching contributions. This means your employer will contribute a certain percentage of your salary to your retirement account, provided you also contribute. This is essentially free money, and it is crucial to take full advantage of it. Always check with your employer’s human resources department to understand the specifics of their matching contribution program.

Failure to maximize these employer contributions represents a significant missed opportunity for growing your retirement savings.

Investment Options within Retirement Accounts

| Investment Option | Risk Level | Potential Return | Suitability |

|---|---|---|---|

| Stocks | High | High | Suitable for long-term investors with higher risk tolerance. |

| Bonds | Low | Low to Moderate | Suitable for investors seeking stability and lower risk. |

| Mutual Funds | Moderate to High (depending on fund) | Moderate to High (depending on fund) | Offers diversification across various asset classes, allowing investors to adjust risk level according to their needs. |

Investment Strategies for Retirement

Planning your investment strategy for retirement requires careful consideration of your risk tolerance, time horizon, and financial goals. A well-structured approach, tailored to your individual circumstances, is crucial for maximizing returns while mitigating potential losses. This section will explore various investment approaches and strategies for different retirement timelines and risk profiles.

Investment Approaches for Varying Risk Tolerances

Individuals have different levels of comfort with risk. Conservative investors prioritize capital preservation and stability, opting for lower-return, lower-risk investments. Moderate investors seek a balance between risk and return, diversifying across various asset classes. Aggressive investors are willing to accept higher risk for potentially higher returns, often allocating a larger portion of their portfolio to higher-growth assets.

Diversified Investment Portfolios for Different Retirement Timelines

The appropriate investment mix varies significantly depending on how far away retirement is. A younger investor with a longer time horizon can typically tolerate more risk and invest a larger portion of their portfolio in equities (stocks), which historically offer higher long-term returns. As retirement nears, a more conservative approach is generally recommended, shifting towards lower-risk investments like bonds and fixed-income securities to protect accumulated savings.

- Long-term (30+ years): A portfolio might consist of 80% stocks (diversified across large-cap, mid-cap, and small-cap companies, potentially including international stocks) and 20% bonds. This allows for significant growth potential while accepting higher short-term volatility.

- Mid-term (10-30 years): A balanced approach could involve 60% stocks and 40% bonds, reducing exposure to risk while still allowing for substantial growth.

- Short-term (less than 10 years): A more conservative strategy might be appropriate, such as 40% stocks and 60% bonds, emphasizing capital preservation.

The Importance of Asset Allocation and Rebalancing

Asset allocation refers to the distribution of investments across different asset classes (stocks, bonds, real estate, etc.). A well-diversified portfolio reduces risk by not relying on the performance of a single asset class. Rebalancing involves periodically adjusting your portfolio to maintain your target asset allocation. As some investments outperform others, rebalancing helps to capture profits from winning investments while reinvesting in underperforming areas, ensuring you remain aligned with your risk tolerance and investment goals.

For example, if your stock allocation grows significantly above your target, you might sell some stocks and buy more bonds to restore the balance.

Strategies for Managing Investment Risk During Market Volatility

Market fluctuations are inevitable. To manage risk during periods of volatility, consider strategies such as dollar-cost averaging (investing a fixed amount at regular intervals, regardless of market conditions), diversification across asset classes and geographies, and having a sufficient emergency fund to cover unexpected expenses. Avoid panic selling during market downturns, as this can lock in losses. Instead, focus on your long-term investment plan and rebalance your portfolio as needed.

Hypothetical Investment Plans

30-Year-Old: Given a longer time horizon, a 30-year-old can afford to take on more risk. A suitable portfolio might include 75% stocks (including growth stocks and emerging market funds), 15% bonds (a mix of government and corporate bonds), and 10% alternative investments (such as real estate investment trusts or commodities). This aggressive approach aims for higher long-term growth, accepting higher volatility in the short term.

50-Year-Old: A 50-year-old approaching retirement needs a more conservative strategy. A suitable portfolio might consist of 50% stocks (focused on more established, dividend-paying companies), 40% bonds (a mix of government and high-quality corporate bonds), and 10% cash or cash equivalents. This balanced approach aims to preserve capital while still generating some growth. The emphasis shifts to capital preservation as retirement draws closer.

Retirement Planning Timeline and Goals

Planning for retirement is a journey, not a sprint. A well-defined timeline and clearly established goals are crucial for ensuring a comfortable and secure retirement. This section Artikels the key steps involved in creating a personalized retirement plan, emphasizing the importance of regular review and adjustment to adapt to life’s changes and economic fluctuations.

Retirement Planning Timeline: A Sample Plan

A successful retirement plan requires a proactive approach. The following timeline provides a general framework, adaptable to individual circumstances and life stages. Remember, this is a sample, and adjustments should be made to reflect your unique situation.

- Ages 25-35: Establish a Foundation: Begin contributing to retirement accounts (401(k), IRA, etc.), even if it’s a small amount. Focus on paying off high-interest debt and building an emergency fund (3-6 months of living expenses).

- Ages 35-45: Accelerate Savings: Increase contributions to retirement accounts. Consider exploring higher-risk investments with potentially greater returns, while maintaining a diversified portfolio.

- Ages 45-55: Consolidate and Strategize: Review your investment strategy and adjust as needed. Consider consolidating multiple retirement accounts to simplify management. Begin planning for healthcare costs in retirement.

- Ages 55-65: Fine-tune and Prepare: Maximize retirement contributions. Begin drawing down on savings if needed, while ensuring sufficient funds for retirement. Explore long-term care insurance options.

- Ages 65+: Enjoy Retirement: Begin drawing retirement income. Monitor your spending and adjust your withdrawal strategy as needed to ensure your funds last throughout retirement.

Setting Realistic and Achievable Retirement Goals

Defining specific, measurable, achievable, relevant, and time-bound (SMART) goals is essential. For example, instead of aiming for a “comfortable retirement,” define it as “having $1 million saved by age 65 to cover living expenses and travel.” This allows for concrete progress tracking. Consider factors such as desired lifestyle, healthcare costs, inflation, and potential longevity. Consider consulting a financial advisor for personalized goal setting.

Regular Review and Adjustments to the Retirement Plan

Life is unpredictable. Regularly reviewing and adjusting your retirement plan is crucial to account for changes in income, expenses, market conditions, and personal circumstances (marriage, children, job loss, health issues). Annual reviews are recommended, with more frequent reviews during periods of significant life changes. This allows for course correction and ensures your plan remains on track.

Calculating Retirement Income Needs

Estimating retirement income needs involves considering current expenses and projecting future inflation. A common approach is to estimate your current annual expenses and then adjust for inflation using a projected annual inflation rate (e.g., 3%). For example, if current annual expenses are $50,000 and the inflation rate is 3%, expenses in 20 years might be approximately $89,000 ($50,000(1.03)^20).

This calculation highlights the importance of starting early and saving aggressively. This is a simplified calculation; a more sophisticated approach may involve considering factors like healthcare costs, taxes, and potential changes in lifestyle.

Creating a Personalized Retirement Plan: A Step-by-Step Guide

- Assess Your Current Financial Situation: Determine your net worth, income, expenses, and debts.

- Define Your Retirement Goals: Establish clear, specific, and measurable goals, considering your desired lifestyle and potential longevity.

- Determine Your Retirement Income Needs: Calculate your estimated retirement expenses, accounting for inflation.

- Choose Retirement Savings Vehicles: Select appropriate vehicles (401(k), IRA, Roth IRA, etc.) based on your tax situation and risk tolerance.

- Develop an Investment Strategy: Create a diversified investment portfolio aligned with your risk tolerance and time horizon.

- Implement and Monitor Your Plan: Begin contributing regularly and monitor your progress. Adjust your plan as needed based on life changes and market conditions.

Successfully navigating the path to a secure retirement requires careful planning, consistent effort, and a proactive approach. By understanding your financial needs, diversifying your investments, and actively managing your debt, you can build a solid financial foundation for your future. Remember, seeking professional financial advice can provide invaluable guidance and support throughout your retirement planning journey. Start planning today – your future self will thank you.

General Inquiries

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions, but withdrawals are taxed in retirement. A Roth IRA has no upfront tax deduction, but withdrawals are tax-free in retirement.

How much should I save for retirement?

A general guideline is to aim for saving at least 10-15% of your pre-tax income, but the ideal amount depends on your individual circumstances, retirement goals, and lifestyle.

When should I start withdrawing from my retirement accounts?

You can typically begin withdrawing from traditional IRAs at age 59 1/2, but you may face penalties for early withdrawals. Roth IRA withdrawals are generally tax-free and penalty-free after age 59 1/2, provided the account has been open for at least five years.

What happens if I don’t have enough saved for retirement?

Insufficient retirement savings can lead to financial hardship in later life. Consider delaying retirement, reducing expenses, or exploring part-time work options to supplement your income.