Securing a comfortable retirement requires careful planning and a clear understanding of your financial goals. A retirement savings calculator can be an invaluable tool in this process, providing projections based on your current savings, contributions, and expected investment returns. Understanding how these calculators work, and the factors that influence their projections, is crucial for making informed decisions about your financial future.

This guide explores the functionality of various retirement calculators, from simple tools to more advanced models incorporating inflation and other variables. We’ll delve into the key factors influencing retirement projections, including investment strategies, contribution consistency, and risk management. We’ll also Artikel effective retirement planning strategies, discuss different savings vehicles, and highlight the importance of financial literacy and professional advice.

Factors Affecting Retirement Savings Projections

Accurately projecting your retirement savings requires considering numerous interconnected factors. Underestimating even one can significantly impact your financial security in later life. This section explores the key elements influencing these projections, emphasizing the importance of a holistic approach to retirement planning.

Inflation’s Impact on Retirement Savings

Inflation erodes the purchasing power of money over time. A dollar today will buy less in the future. Therefore, retirement projections must account for inflation to accurately reflect the real value of your savings. For example, if your projected retirement income is $50,000 annually, but inflation averages 3% per year, that $50,000 will have significantly less buying power in 20 years.

Retirement calculators typically incorporate inflation adjustments, allowing you to see the real value of your savings in future years, rather than simply the nominal value. Failing to consider inflation can lead to a substantial shortfall in your retirement income.

Investment Returns and Their Variability

Investment returns are crucial for retirement savings growth. The rate of return you earn on your investments directly impacts the final amount you accumulate. Different asset classes (stocks, bonds, real estate) offer varying return potentials and levels of risk. Higher-risk investments like stocks historically offer higher returns but also carry greater volatility. Conversely, lower-risk investments like bonds typically provide more stable, but lower returns.

A diversified investment portfolio, strategically aligned with your risk tolerance and time horizon, is essential for maximizing returns while mitigating risk. For instance, a younger investor with a longer time horizon might tolerate a higher proportion of stocks in their portfolio, while an older investor nearing retirement might prefer a more conservative approach with a greater allocation to bonds.

Lifespan and Longevity Risk

Estimating your lifespan is inherently uncertain, yet crucial for accurate retirement planning. People are living longer, increasing the need for larger retirement savings. Underestimating your lifespan can lead to running out of funds before you die. While no one can predict their exact lifespan, using actuarial tables and considering family history can provide a reasonable estimate. Planning for a longer lifespan involves saving more aggressively or considering strategies to generate income during retirement, such as part-time work or downsizing a home.

Unexpected Expenses and Contingencies

Life throws curveballs. Unexpected medical expenses, home repairs, or family emergencies can significantly deplete retirement savings. It’s crucial to incorporate a contingency buffer into your retirement plan to absorb these unforeseen costs. This buffer might involve holding a separate emergency fund or maintaining a higher savings target than initially calculated. For instance, a sudden health crisis could easily wipe out years of savings if not properly accounted for.

Adequate insurance coverage (health, long-term care) is also essential in mitigating the impact of unexpected expenses.

Consistent vs. Irregular Contributions

Consistent contributions, even small ones, significantly benefit long-term savings due to the power of compounding. Regular contributions allow your investments to grow exponentially over time. Irregular contributions, while potentially larger at times, miss out on the benefits of consistent growth. Consider this example: $100 invested monthly for 30 years at an average annual return of 7% will accumulate significantly more than the same total amount invested irregularly over the same period.

The consistent approach maximizes the compounding effect, leading to a larger nest egg.

Risk Management and Uncertainty in Retirement Planning

Managing risk involves diversifying investments, carefully considering your risk tolerance, and regularly reviewing your portfolio. Uncertainty is inherent in retirement planning. To mitigate this, regularly review your retirement plan, adjust your savings rate as needed, and consider seeking professional financial advice. Using a retirement calculator provides a valuable tool to simulate different scenarios and assess the impact of various factors on your retirement projections.

This allows for proactive adjustments to your plan, ensuring you remain on track to achieve your retirement goals.

Retirement Planning Strategies and Savings Goals

Planning for retirement involves more than just saving money; it’s about strategically managing your finances to achieve a comfortable and secure future. This requires a well-defined plan encompassing various strategies and realistic savings goals tailored to your individual circumstances and aspirations. Understanding these elements is crucial for building a robust retirement nest egg.

Retirement Planning Strategies

Effective retirement planning leverages diverse strategies to maximize growth and mitigate risk. A well-rounded approach considers the interplay between investment vehicles, contribution frequency, and asset allocation.

- Lump-Sum Investment: This strategy involves investing a significant amount of money at once, typically benefiting from potential compounding returns over a longer period. However, it requires having a substantial sum available upfront and carries market risk, as the investment’s value can fluctuate. For example, receiving a large inheritance or bonus could be used for this approach.

- Regular Contributions: This involves consistently contributing smaller amounts over time, often through automatic deductions from a paycheck. This approach mitigates the risk associated with lump-sum investments and allows for dollar-cost averaging, reducing the impact of market volatility. A consistent $500 monthly contribution to a 401(k) is a common example.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) is crucial for risk management. Diversification helps reduce the impact of poor performance in one area by balancing it with potentially better performance in others. A portfolio diversified across stocks, bonds, and mutual funds is a typical example.

Realistic Retirement Savings Goals

Setting realistic savings goals depends on your desired lifestyle in retirement, current savings, and time horizon. Consider factors such as healthcare costs, travel plans, and desired living expenses.

- Comfortable Retirement: Maintaining a similar lifestyle to your pre-retirement years might require saving 80-90% of your pre-retirement income. For example, if your pre-retirement income was $100,000, you might aim to have $80,000-$90,000 in annual retirement income.

- Modest Retirement: A more modest lifestyle might require saving 50-70% of your pre-retirement income. This might involve downsizing your home or making adjustments to your spending habits. For a $100,000 pre-retirement income, this translates to $50,000-$70,000 in annual retirement income.

- Luxury Retirement: Maintaining a significantly higher standard of living in retirement would require saving significantly more than your pre-retirement income, perhaps 100% or even more, depending on the desired lifestyle. This might involve maintaining a large home, frequent travel, and extensive leisure activities.

Setting Realistic Retirement Savings Goals: A Step-by-Step Guide

Establishing realistic retirement savings goals requires a structured approach.

- Determine your desired retirement lifestyle: Consider your spending habits, desired activities, and healthcare needs.

- Estimate your retirement expenses: Account for housing, healthcare, food, transportation, and entertainment.

- Calculate your retirement income needs: This is the total annual income required to support your desired lifestyle.

- Assess your current savings and investments: Determine your starting point.

- Determine the time horizon until retirement: The longer the time horizon, the more time you have for your investments to grow.

- Calculate your required annual savings rate: Use online retirement calculators or financial advisors to estimate the amount you need to save annually to reach your goal.

- Adjust your savings plan as needed: Regularly review and adjust your savings plan based on your progress and changing circumstances.

Retirement Savings Vehicles

Several vehicles facilitate retirement savings, each with unique advantages and disadvantages.

- 401(k): Employer-sponsored retirement plan offering tax advantages. Pros: Tax-deferred growth, potential employer matching contributions. Cons: Limited investment options, potential penalties for early withdrawals.

- Traditional IRA: Individual Retirement Account offering tax-deductible contributions. Pros: Tax-deductible contributions, tax-deferred growth. Cons: Taxes on withdrawals in retirement, contribution limits.

- Roth IRA: Individual Retirement Account with tax-free withdrawals in retirement. Pros: Tax-free withdrawals in retirement, no required minimum distributions (RMDs). Cons: Non-deductible contributions, income limitations for contributions.

Using Retirement Savings Calculators Effectively

Retirement savings calculators are valuable tools, offering a glimpse into your potential financial future. However, understanding their strengths and limitations is crucial for making sound financial decisions. These calculators provide estimates, not guarantees, and their accuracy depends heavily on the inputs you provide. This section will guide you on interpreting calculator outputs, recognizing their limitations, and using them effectively in your retirement planning.

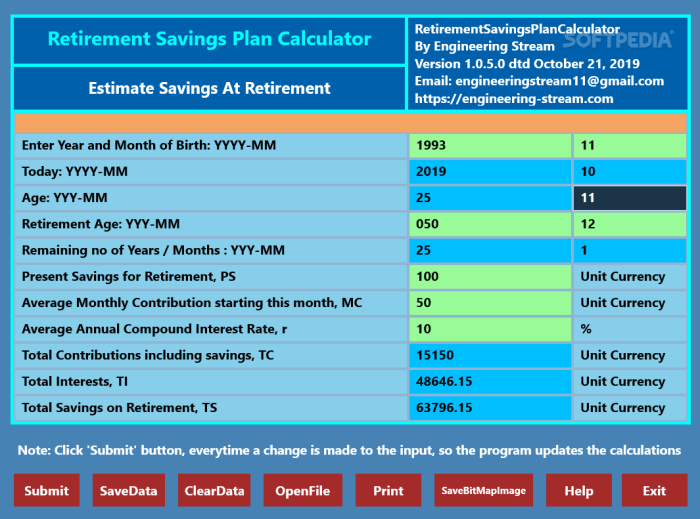

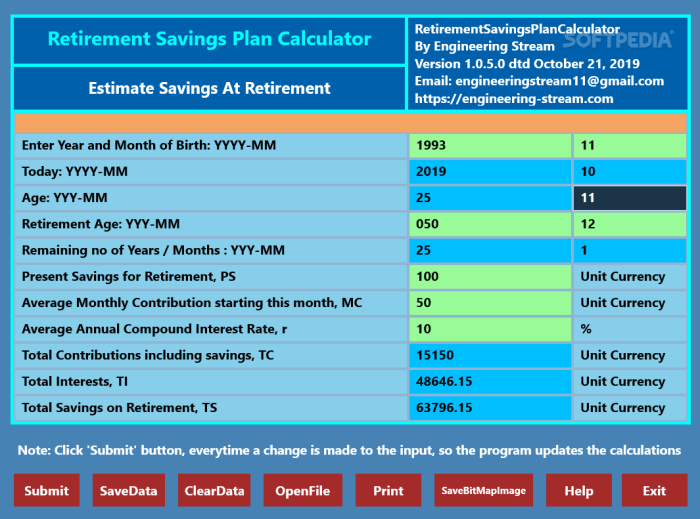

Interpreting Retirement Savings Calculator Output

Retirement calculators typically present projections of your potential retirement income based on various factors you input, such as current age, desired retirement age, current savings, expected annual contributions, and assumed investment returns. The output often includes a projected nest egg at retirement and an estimated monthly income during retirement, potentially illustrating different scenarios based on varying contribution levels or investment growth rates.

For example, a calculator might show that contributing $500 monthly for 30 years with a 7% annual return could result in a retirement nest egg of approximately $500,000, yielding a monthly income of roughly $2,000. However, remember that these are estimates, not precise predictions.

Limitations and Potential Inaccuracies of Retirement Savings Calculators

It’s essential to acknowledge that retirement calculators rely on assumptions and estimations. These assumptions, such as future investment returns and inflation rates, are inherently uncertain and can significantly impact the final projection. Unexpected life events, like job loss or major medical expenses, are rarely factored in, yet they can drastically affect savings accumulation. Furthermore, the calculators typically assume a constant rate of return, ignoring the volatility inherent in the investment markets.

For instance, a calculator might project a 7% annual return consistently over 30 years, while in reality, returns will fluctuate year to year, potentially leading to higher or lower nest eggs than projected. Additionally, tax implications are often simplified or omitted, affecting the accuracy of the final figures.

Tips for Using a Retirement Savings Calculator to Make Informed Financial Decisions

To maximize the usefulness of a retirement calculator, use multiple calculators from different sources, comparing their projections. This helps identify the range of possible outcomes and reduces reliance on a single source’s assumptions. Experiment with various input values, exploring the sensitivity of the projections to changes in contribution amounts, investment returns, and retirement age. Consider consulting a financial advisor to discuss the calculator’s outputs in the context of your individual circumstances and risk tolerance.

Don’t solely rely on the calculator’s recommendations; view it as a tool to aid, not replace, informed financial planning.

Checklist Before Relying on a Retirement Savings Calculator

Before making significant financial decisions based solely on a retirement calculator’s projections, consider the following:

- Have you considered inflation’s impact on your future expenses?

- Have you factored in potential unexpected expenses, such as healthcare costs or home repairs?

- Have you considered the potential impact of taxes on your retirement income?

- Have you reviewed your current financial situation, including debt and other liabilities?

- Have you considered diversifying your investment portfolio to mitigate risk?

- Have you sought advice from a qualified financial advisor to tailor a plan to your specific needs and circumstances?

Planning for retirement is a journey, not a destination. While a retirement savings calculator provides valuable projections, it’s essential to remember that these are estimates, influenced by numerous variables. By understanding these variables, adopting effective saving strategies, and seeking professional guidance when needed, you can increase your confidence in achieving your retirement goals. Remember, proactive planning and informed decision-making are key to a secure and fulfilling retirement.

Questions Often Asked

What if I don’t have any current savings?

Many calculators allow you to input zero for current savings. Focus on realistic future contribution amounts and investment growth rates.

How accurate are these calculators?

Calculators provide estimates based on input data. Actual results may vary due to market fluctuations and unforeseen circumstances.

Can I use a calculator to plan for early retirement?

Yes, most calculators allow you to adjust the retirement age. However, early retirement requires significantly higher savings and/or contributions.

What happens if my investment returns are lower than expected?

Lower returns will result in a lower projected retirement income. Consider adjusting contributions or reevaluating your retirement age.