Securing a comfortable retirement requires careful planning and proactive saving. This guide delves into the multifaceted world of retirement preparation, covering everything from understanding your individual needs and choosing the right savings vehicles to developing sound investment strategies and managing debt effectively. We’ll explore various approaches, helping you navigate the complexities and build a secure financial future.

From defining your retirement goals and calculating estimated expenses to understanding the intricacies of 401(k)s, IRAs, and Roth IRAs, this comprehensive resource equips you with the knowledge to make informed decisions about your financial well-being. We’ll also address the crucial role of investment strategies, risk management, and the importance of seeking professional advice when needed.

Seeking Professional Advice

Planning for retirement can be complex, involving numerous financial instruments, tax implications, and personal considerations. Navigating this landscape effectively often necessitates seeking professional guidance. A well-informed decision about your retirement future can significantly impact your quality of life during your golden years.Financial advisors and retirement planners play distinct but often overlapping roles in helping individuals achieve their retirement goals.

Financial advisors offer a broader scope, encompassing investment management, estate planning, and tax strategies. Retirement planners, on the other hand, focus specifically on retirement income planning, helping individuals create a strategy to ensure a steady stream of income throughout retirement. While the lines can blur, understanding their core specializations is key to selecting the right professional.

Roles of Financial Advisors and Retirement Planners

Financial advisors provide comprehensive financial planning services, assisting clients with various aspects of their financial lives, including investments, budgeting, debt management, and estate planning. Their expertise extends to diverse investment vehicles like stocks, bonds, mutual funds, and real estate. Retirement planners, a subset of financial advisors, specialize in creating and implementing retirement income strategies. They help clients determine how much they need to save, what investment strategies to use, and how to access their retirement funds efficiently and tax-effectively.

They may also assist with Social Security and pension planning.

Benefits of Seeking Professional Guidance

Seeking professional guidance offers several key benefits. A financial advisor or retirement planner can provide an objective assessment of your current financial situation, identify potential risks, and develop a personalized retirement plan tailored to your specific goals and circumstances. They can help you navigate the complexities of investment choices, ensuring your portfolio is aligned with your risk tolerance and retirement timeline.

Furthermore, they can provide ongoing support and adjustments to your plan as your circumstances change. For example, a planner could help you adjust your strategy after an unexpected job loss or a change in family circumstances. The peace of mind that comes from having a structured plan and expert guidance is invaluable.

Questions to Ask When Choosing a Financial Advisor

Choosing a financial advisor requires careful consideration. It’s crucial to understand their qualifications, experience, fee structure, and investment philosophy. Understanding their approach to risk management and their track record are essential aspects to evaluate. Additionally, you should inquire about their client base and their experience with individuals in similar situations as yours. Finally, verifying their credentials and affiliations with professional organizations provides an added layer of assurance.

Essential Information to Share with a Financial Advisor

Before your initial meeting, gather essential financial information. This includes your current income, assets (including retirement accounts, savings, and investments), debts, and expenses. Providing a detailed overview of your retirement goals—when you plan to retire, your desired lifestyle, and estimated expenses—is crucial. Sharing your risk tolerance and investment preferences will enable your advisor to tailor a suitable investment strategy.

It is also important to disclose any existing health concerns, as these may influence your retirement planning needs.

Retirement Savings and Healthcare Costs

Planning for retirement requires careful consideration of various factors, and healthcare costs represent a significant, often underestimated, expense. Failing to adequately account for these costs can severely impact your retirement lifestyle and financial security. Understanding the potential impact and implementing effective mitigation strategies is crucial for a comfortable and financially stable retirement.

Healthcare Costs’ Impact on Retirement Planning

Healthcare expenses in retirement can be substantial and unpredictable. Factors such as age, pre-existing conditions, and the need for long-term care significantly influence the overall cost. Unexpected medical emergencies or chronic illnesses can quickly deplete retirement savings, forcing retirees to compromise their living standards or rely heavily on family support. For instance, a single unexpected hospitalization can easily cost tens of thousands of dollars, a considerable sum for someone living on a fixed retirement income.

Therefore, proactive planning and budgeting are essential to ensure sufficient funds are available to cover potential healthcare needs.

Strategies for Mitigating Healthcare Expenses in Retirement

Several strategies can help mitigate the financial burden of healthcare in retirement. Maintaining a healthy lifestyle through regular exercise, a balanced diet, and preventative screenings can reduce the likelihood of developing costly health problems. Exploring options such as Medicare Advantage plans or supplemental insurance can help cover gaps in Medicare coverage. Additionally, understanding the nuances of Medicare and its various parts is crucial for making informed decisions.

Furthermore, creating a detailed healthcare budget, factoring in potential increases in costs over time, is essential for responsible financial planning. Finally, considering long-term care insurance can protect against the potentially devastating costs associated with nursing home care or in-home assistance.

The Role of Health Insurance in Retirement Planning

Health insurance plays a pivotal role in retirement planning, providing financial protection against the unpredictable costs of medical care. Medicare, the primary health insurance program for those 65 and older, provides essential coverage but doesn’t cover all expenses. Understanding Medicare’s different parts – Part A (hospital insurance), Part B (medical insurance), Part D (prescription drug insurance), and Medicare Advantage plans – is crucial for selecting the most suitable coverage.

Supplemental insurance, also known as Medigap, can help fill the gaps in Medicare coverage, reducing out-of-pocket expenses. Careful consideration of insurance options and their associated costs is essential for ensuring adequate protection without overburdening retirement finances.

Comparison of Healthcare Options for Retirees

| Option | Coverage | Cost | Pros | Cons |

|---|---|---|---|---|

| Original Medicare (Parts A & B) | Hospital and medical insurance | Premiums and deductibles vary | Widely accepted, relatively simple to understand | Significant out-of-pocket costs possible, no prescription drug coverage |

| Medicare Advantage (Part C) | Comprehensive coverage, often including prescription drugs | Premiums and co-pays vary by plan | Lower out-of-pocket costs for some, often includes extra benefits | Limited choice of doctors and hospitals, may require referrals |

| Medicare Supplement (Medigap) | Helps cover Medicare’s out-of-pocket costs | Monthly premiums vary by plan | Reduces out-of-pocket expenses, broader access to providers | Additional monthly cost on top of Medicare premiums |

| Medicaid | Covers medical costs for low-income individuals | Income-based eligibility requirements | Comprehensive coverage at little to no cost | Strict eligibility requirements, may limit provider choices |

Retirement Savings

Planning for a comfortable retirement requires a proactive and strategic approach. This involves consistent saving, smart investment choices, and a realistic understanding of future expenses. A well-structured plan, adapted to individual circumstances, can significantly impact the quality of life in retirement.

A Successful Retirement Savings Plan: The Case of Sarah Miller

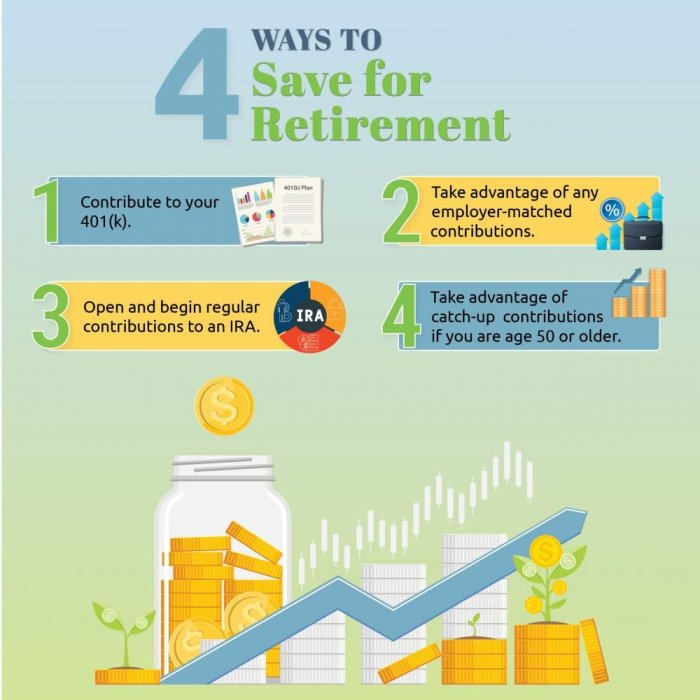

Sarah Miller, a 25-year-old marketing professional, started saving for retirement early. Recognizing the power of compound interest, she prioritized consistent contributions to her 401(k) plan from the beginning of her career. She chose a diversified investment portfolio, balancing low-risk investments like bonds with higher-risk, higher-potential-return investments like stocks. Throughout her career, she increased her contributions as her income grew, aiming for at least 15% of her pre-tax income.

She also took advantage of employer matching contributions, maximizing the free money offered by her company. Further, Sarah consistently monitored her portfolio, making adjustments as needed based on market conditions and her changing life circumstances. She also regularly reviewed her retirement projections to ensure she was on track to meet her goals.

Impact of Sarah’s Choices

Sarah’s disciplined approach yielded significant results. By consistently contributing to her 401(k) and making strategic investment choices, she accumulated a substantial retirement nest egg by the age of 65. The power of compound interest played a crucial role, allowing her initial investments to grow exponentially over time. Her diversified portfolio helped mitigate the risk of market downturns, ensuring a more stable growth trajectory.

Maximizing employer matching contributions further boosted her savings, essentially increasing her return on investment. Regular portfolio monitoring and adjustments ensured her investments remained aligned with her risk tolerance and financial goals. This proactive approach allowed her to retire comfortably and pursue her passions without financial worries.

Key Lessons Learned

This case study highlights several crucial lessons for retirement planning. First, starting early is paramount. The earlier one begins saving, the more time compound interest has to work its magic. Second, diversification is key to managing risk. Spreading investments across different asset classes reduces the impact of market fluctuations.

Third, maximizing employer matching contributions is a simple yet effective way to boost savings. Fourth, regular monitoring and adjustments are essential to ensure the plan remains aligned with goals and changing circumstances. Finally, consistent contributions, even small ones, over time accumulate significantly.

Applying Sarah’s Strategies to Different Situations

While Sarah’s situation is specific, the core principles of her plan can be adapted to various circumstances. For individuals with lower incomes, focusing on maximizing employer matching contributions and gradually increasing contributions as income allows is crucial. Those with higher risk tolerance can allocate a larger portion of their portfolio to stocks, potentially achieving higher returns. Individuals with specific retirement goals, such as early retirement or funding long-term care, may need to adjust their savings rate and investment strategy accordingly.

Regardless of individual circumstances, the principles of early saving, diversification, and consistent monitoring remain vital for building a secure retirement.

Planning for retirement is a journey, not a destination. By understanding your financial needs, selecting appropriate savings vehicles, implementing sound investment strategies, and regularly reviewing your plan, you can build a strong foundation for a secure and fulfilling retirement. Remember that seeking professional advice can provide invaluable support and guidance throughout this process, ensuring you’re on the right path toward achieving your retirement goals.

Take control of your financial future today and start planning for a comfortable tomorrow.

Helpful Answers

What is the best retirement savings account for me?

The best account depends on your individual circumstances, including your income, tax bracket, risk tolerance, and time horizon. Factors like tax advantages and contribution limits should be carefully considered.

When should I start saving for retirement?

The sooner you start, the better. Even small contributions early on can grow significantly over time due to compounding interest.

How much should I save for retirement?

A general guideline is to aim to replace 80% of your pre-retirement income. However, this varies greatly depending on individual circumstances and desired lifestyle.

What if I lose my job before retirement?

Having an emergency fund and exploring options like unemployment benefits can help bridge the gap. Reviewing and adjusting your retirement plan is also crucial during such life changes.

How do I protect my retirement savings from inflation?

Consider investing in assets that tend to outpace inflation, such as stocks and real estate. Regularly reviewing and adjusting your investment strategy is also essential.