Securing a comfortable retirement requires proactive planning and strategic saving. This guide provides a comprehensive roadmap to help you boost your retirement nest egg, covering everything from understanding your current financial situation to exploring various investment options and managing debt effectively. We’ll explore practical strategies to maximize your contributions, navigate different retirement accounts, and make informed decisions about your financial future.

Building a robust retirement plan isn’t about overnight riches; it’s about consistent effort and smart choices. By implementing the strategies Artikeld here, you can take control of your financial destiny and build a secure future. We will delve into actionable steps, offering clear explanations and real-world examples to empower you to achieve your retirement goals.

Understanding Your Current Financial Situation

Before you can effectively boost your retirement savings, a clear understanding of your current financial standing is crucial. This involves a thorough assessment of your income, expenses, and existing savings to establish a realistic baseline and identify areas for improvement. Knowing where your money is going and how much you have available allows you to create a targeted savings plan.Creating a robust retirement savings strategy begins with a realistic appraisal of your financial health.

This involves meticulously tracking your income, expenses, and assets to gain a comprehensive view of your current financial situation. This knowledge forms the foundation for setting achievable savings goals and developing effective strategies to reach them.

Assessing Income, Expenses, and Existing Savings

To accurately assess your financial situation, you need to gather information on your income, expenses, and existing savings. Start by compiling all your income sources, including your salary, investments, and any other regular income streams. Next, meticulously track your expenses for at least one month, categorizing them into essential (housing, food, utilities) and non-essential (entertainment, dining out, subscriptions) spending.

Finally, calculate your total savings, including retirement accounts (401(k), IRA), savings accounts, and any other investments. This comprehensive overview provides a solid foundation for financial planning.

Creating a Personal Budget

A personal budget is a crucial tool for identifying areas where you can reduce expenses and increase savings. Follow these steps to create your budget:

- Track your spending: For a month, record every expense, no matter how small. Use budgeting apps, spreadsheets, or even a notebook.

- Categorize your expenses: Organize your expenses into categories like housing, transportation, food, entertainment, etc. This will help you visualize where your money is going.

- Calculate your net income: Subtract your total expenses from your total income to determine your net income (the money you have left after expenses).

- Allocate your net income: Assign portions of your net income to different categories, such as savings, debt payments, and essential expenses. Prioritize savings to ensure consistent contributions to your retirement fund.

- Review and adjust: Regularly review your budget and make adjustments as needed. Your spending habits and income may change over time, requiring adjustments to your budget.

For example, if your net income is $3,000 per month, you might allocate $500 to retirement savings, $1,000 to essential expenses, $500 to non-essential expenses, and $1,000 to debt repayment. Adjusting these allocations based on your priorities is key.

Calculating Net Worth and Identifying Assets

Calculating your net worth provides a snapshot of your overall financial health. Your net worth is simply the difference between your assets (what you own) and your liabilities (what you owe).To calculate your net worth:

- List your assets: Include the value of your house, car, investments (stocks, bonds, mutual funds), savings accounts, retirement accounts, and any other valuable possessions.

- List your liabilities: Include the outstanding balances on your mortgage, car loan, credit cards, student loans, and any other debts.

- Subtract liabilities from assets: Subtract the total value of your liabilities from the total value of your assets. The result is your net worth.

Net Worth = Total Assets – Total Liabilities

For instance, if your assets total $200,000 and your liabilities total $50,000, your net worth is $150,000. Regularly reviewing and updating your net worth allows you to monitor your financial progress and make necessary adjustments to your financial plan.

Setting Realistic Retirement Goals

Planning for retirement involves more than just saving money; it requires setting clear, achievable goals that align with your desired lifestyle. This involves understanding your spending habits, projecting future expenses, and determining the necessary savings to support your retirement vision. Failing to establish realistic goals can lead to insufficient savings and a less comfortable retirement than anticipated.Determining your retirement income target requires careful consideration of your lifestyle expectations.

Think about how you envision spending your retirement years. Will you travel extensively? Do you plan to pursue hobbies that require significant financial investment? Will you need to cover ongoing healthcare expenses? By honestly assessing your future needs and wants, you can create a more accurate picture of your required retirement income.

Retirement Income Target Calculation

To calculate your required retirement income, you’ll need to estimate your annual expenses in retirement. This includes essential expenses like housing, food, utilities, and healthcare, as well as discretionary spending like travel, entertainment, and hobbies. One approach is to analyze your current spending patterns, adjusting for anticipated changes in retirement. For example, you might anticipate lower work-related expenses but higher healthcare costs.

You can also use online retirement calculators or consult with a financial advisor to get a personalized estimate. It’s crucial to account for inflation, which will erode the purchasing power of your savings over time. A common strategy is to use an inflation rate of 3% annually when projecting future expenses.

Retirement Scenarios and Savings Needs

Consider these scenarios to illustrate the range of savings needed for different retirement lifestyles:Scenario 1: A modest retirement, focusing on essential expenses. This scenario might involve downsizing a home, reducing travel, and minimizing discretionary spending. The required savings would be significantly lower than for a more extravagant lifestyle. For example, a couple might need $40,000 annually, requiring approximately $1 million in savings, assuming a 4% withdrawal rate.Scenario 2: A comfortable retirement, allowing for some discretionary spending and occasional travel.

This scenario might involve maintaining a similar lifestyle to pre-retirement, with some adjustments. This could require $80,000 annually, necessitating approximately $2 million in savings, again assuming a 4% withdrawal rate.Scenario 3: A luxurious retirement, with extensive travel, hobbies, and a high standard of living. This scenario would require a significantly larger nest egg. Annual expenses might reach $150,000 or more, demanding potentially $3.75 million or more in savings, maintaining the 4% withdrawal rate.

Retirement Savings Calculation Worksheet

This worksheet helps you estimate your retirement savings needs:

| Item | Estimated Annual Expense (Today’s Dollars) | Adjusted for Inflation (Future Dollars) |

|---|---|---|

| Housing | ||

| Food | ||

| Utilities | ||

| Healthcare | ||

| Transportation | ||

| Entertainment | ||

| Travel | ||

| Other | ||

| Total Annual Expenses (Future Dollars) |

To estimate future expenses, multiply today’s expenses by (1 + inflation rate)^number of years until retirement. For example, for 20 years and 3% inflation, the multiplier is (1.03)^20 ≈ 1.806.

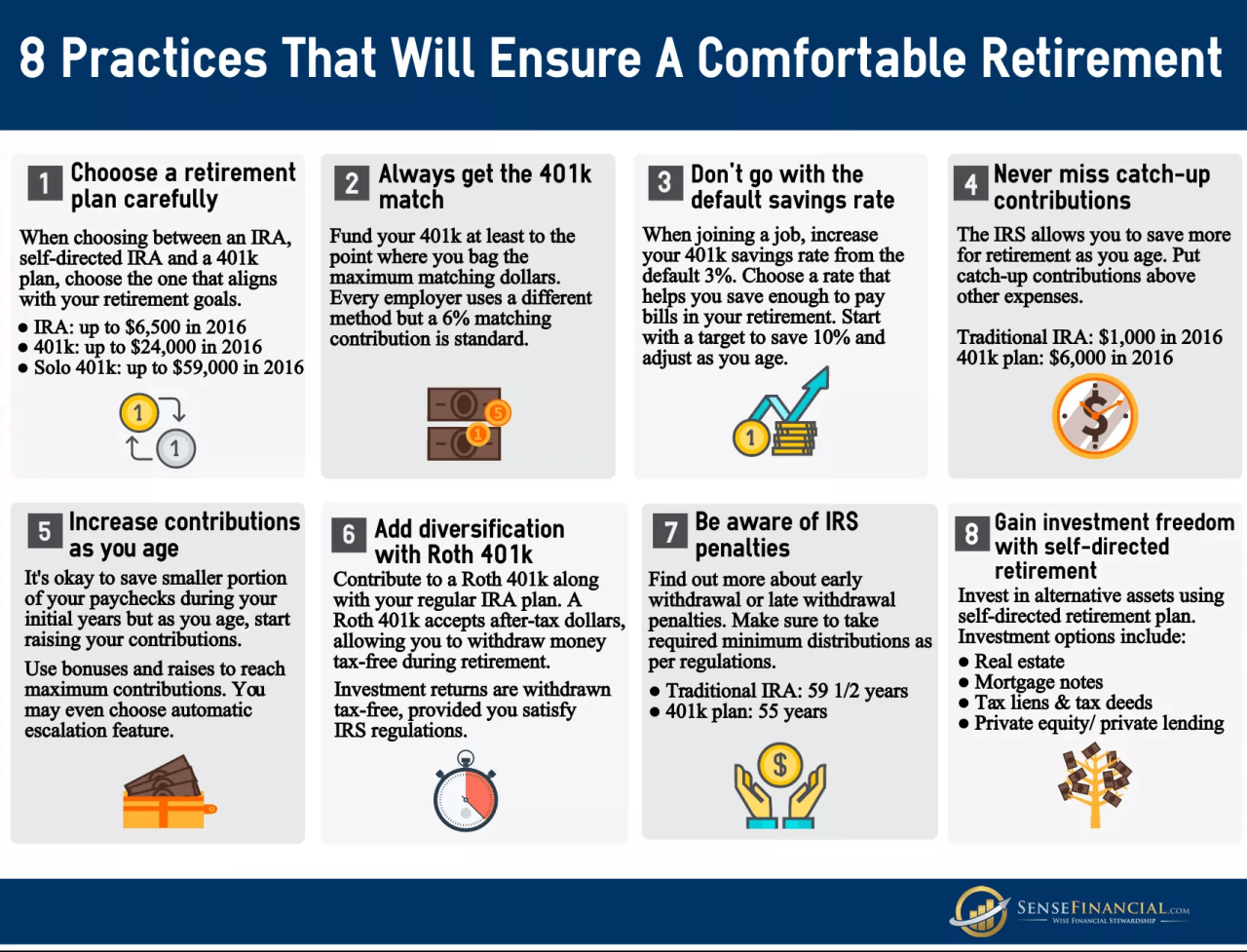

Successfully increasing your retirement savings hinges on a multifaceted approach. By carefully assessing your current financial standing, setting realistic goals, maximizing contributions to retirement accounts, and implementing sound investment strategies, you can significantly improve your financial security in retirement. Remember that seeking professional financial advice can provide personalized guidance tailored to your specific circumstances. Take the steps today to build a brighter and more financially secure tomorrow.

Query Resolution

What is the difference between a Roth IRA and a Traditional IRA?

A Roth IRA offers tax-free withdrawals in retirement, but contributions are made after tax. A Traditional IRA allows for tax-deductible contributions, but withdrawals are taxed in retirement.

How much should I be saving for retirement?

A general guideline is to aim to save at least 15% of your pre-tax income, but the ideal amount depends on your age, income, expenses, and retirement goals.

What if I don’t have an employer-sponsored retirement plan?

You can still contribute to an IRA or other self-directed retirement accounts to build your savings. Consider opening a Roth IRA or Traditional IRA to start building retirement savings.

When should I start withdrawing from my retirement accounts?

You can typically begin withdrawing from traditional retirement accounts at age 59 1/2 without penalty, although early withdrawals may incur taxes. Required minimum distributions (RMDs) begin at age 73 (or 75 for those born in 1960 or later).