Retirement, a period often envisioned as tranquil and relaxing, can be significantly impacted by the often-overlooked reality of escalating healthcare costs. Understanding these expenses is crucial for ensuring financial security and peace of mind during this important life stage. This exploration delves into the complexities of healthcare financing in retirement, examining strategies for planning, budgeting, and mitigating potential financial burdens.

From navigating the intricacies of Medicare and supplemental insurance to developing effective savings strategies, we’ll provide a comprehensive overview of the financial landscape of healthcare in retirement. We will also consider the various long-term care options available and their associated costs, empowering you to make informed decisions that protect your financial well-being.

Understanding Healthcare Costs in Retirement

Planning for retirement often focuses on savings and investments, but healthcare expenses represent a significant and often unpredictable cost. Understanding these costs is crucial for ensuring financial security in later life. This section will Artikel typical healthcare expenses, explore the role of Medicare, and examine how various factors influence overall costs.

Typical Healthcare Expenses in Retirement

Retirees face a range of healthcare expenses, many of which are not fully covered by Medicare. Medicare, the federal health insurance program for people 65 and older and some younger people with disabilities, helps to cover some costs but leaves significant portions as out-of-pocket expenses. These out-of-pocket expenses can quickly accumulate and significantly impact a retiree’s budget.

Breakdown of Common Healthcare Expenses

Common healthcare expenses for retirees include prescription drugs, doctor visits, hospital stays, and long-term care. Prescription drug costs can be substantial, even with Medicare Part D coverage, which often requires significant co-pays and deductibles. Doctor visits, routine checkups, and specialist consultations add up over time. Unexpected medical events, such as accidents or serious illnesses, can lead to substantial unforeseen expenses.

Long-term care, including nursing homes or in-home assistance, is another significant potential cost that many people fail to adequately plan for. These expenses can vary widely based on individual circumstances and needs.

Factors Influencing Healthcare Costs

Several factors significantly influence healthcare costs in retirement. Geographic location plays a crucial role, with costs varying considerably across states and regions. A retiree’s overall health status is another key determinant; individuals with pre-existing conditions or chronic illnesses will generally incur higher expenses. Lifestyle choices, such as diet and exercise, can also influence healthcare costs by affecting the likelihood of developing chronic conditions.

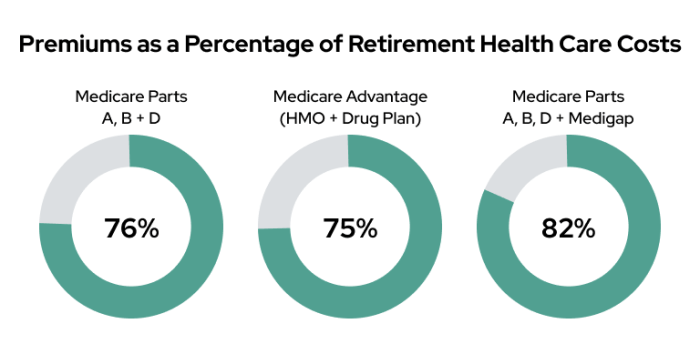

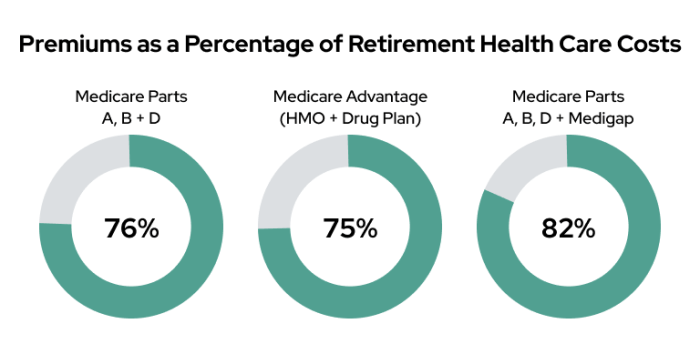

Finally, the type of health insurance coverage a retiree chooses, beyond basic Medicare, will dramatically affect out-of-pocket expenses. Supplemental insurance like Medigap plans or Medicare Advantage plans can help reduce costs, but they come with their own premiums and limitations.

Average Healthcare Costs by Age Group

The following table provides an estimated comparison of average annual healthcare costs for different age groups in retirement. It’s crucial to remember that these are averages, and individual experiences will vary significantly. The data used to create this table is based on industry reports and may not reflect specific individual circumstances.

| Age Group | Average Annual Cost | Breakdown of Costs | Factors Influencing Cost |

|---|---|---|---|

| 65-74 | $10,000 – $15,000 | Prescription drugs, doctor visits, preventative care | Health status, location, supplemental insurance |

| 75-84 | $15,000 – $25,000 | Increased prescription drug costs, more frequent doctor visits, potential for chronic conditions | Increased likelihood of chronic illness, need for more extensive care |

| 85+ | $25,000+ | Significant increase in healthcare needs, potential for long-term care | High probability of chronic illness, potential need for assisted living or nursing home care |

Planning for Healthcare Expenses During Retirement

Planning for healthcare costs in retirement is crucial, as medical expenses can significantly impact your financial security during this phase of life. Failing to adequately prepare can lead to substantial financial strain and compromise your desired lifestyle. This section Artikels strategies to effectively estimate, save for, and manage healthcare expenses in retirement.

Estimating Future Healthcare Costs

Accurately predicting future healthcare costs is challenging due to fluctuating inflation rates and the unpredictable nature of health changes. However, employing several strategies can improve your estimations. Start by reviewing your current healthcare spending. Consider factors such as doctor visits, prescription medications, and any existing health conditions. Then, utilize online calculators and tools that project future healthcare costs, incorporating inflation rates.

These calculators often allow you to input various scenarios, such as potential health deterioration or the need for long-term care. Remember to consult with a financial advisor who can help you personalize these projections based on your individual circumstances and risk tolerance. For example, a 65-year-old couple with relatively good health might project annual healthcare costs of $15,000, but this could easily double or triple with the onset of chronic conditions like diabetes or heart disease.

Comprehensive Retirement Healthcare Planning

A comprehensive retirement healthcare plan is an integral component of overall retirement planning. It should be integrated with your financial plan, considering all aspects of healthcare expenses, including insurance coverage, savings strategies, and potential long-term care needs. This plan should account for both expected and unexpected medical expenses, ensuring you have sufficient resources to cover them without jeopardizing your retirement savings or lifestyle.

For instance, a comprehensive plan might include a combination of Medicare, supplemental insurance, a health savings account, and a long-term care insurance policy. This multi-faceted approach provides a safety net against various healthcare scenarios.

Methods for Saving for Healthcare Expenses

Several effective methods exist for saving specifically for healthcare expenses in retirement. Health Savings Accounts (HSAs) are tax-advantaged accounts available to individuals enrolled in high-deductible health plans. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are tax-free. HSAs offer a powerful tool for long-term healthcare savings. Furthermore, investing in a diversified portfolio can help generate returns to cover future healthcare costs.

While riskier than HSAs, this approach can potentially yield higher returns over the long term. Finally, allocating a portion of your overall retirement savings specifically for healthcare expenses provides a dedicated fund to draw from during retirement. The allocation percentage should depend on individual circumstances and risk tolerance.

Long-Term Care Options: Advantages and Disadvantages

Long-term care (LTC) refers to the ongoing assistance needed for individuals who can no longer perform daily tasks independently. Several options exist, each with its own advantages and disadvantages. Long-term care insurance policies provide financial protection against the high costs of LTC services, such as nursing homes or in-home care. However, premiums can be expensive, and coverage details vary significantly.

Conversely, self-insurance relies on personal savings and assets to fund LTC needs. This option offers greater control but carries the risk of depleting savings if extensive care is required. Finally, Medicaid, a government program, provides LTC coverage for low-income individuals, but qualification criteria can be stringent. Choosing the right option depends on individual health status, financial resources, and risk tolerance.

A thorough assessment of each option is essential before making a decision.

Medicare and Supplemental Insurance in Retirement

Understanding Medicare and supplemental insurance options is crucial for managing healthcare costs in retirement. Navigating the complexities of these programs can feel daunting, but a clear understanding of their coverage and benefits can significantly impact your financial well-being during your later years. This section will provide an overview of the different parts of Medicare and explain when supplemental insurance might be a beneficial addition.

Medicare Parts A, B, C, and D

Medicare is a federal health insurance program for people 65 or older and some younger people with disabilities. It’s comprised of four parts, each offering different types of coverage. Part A covers hospital insurance, including inpatient care, skilled nursing facilities, hospice, and some home healthcare. Part B covers medical insurance, such as doctor visits, outpatient care, and some preventive services.

Part C, also known as Medicare Advantage, offers an alternative way to receive your Medicare benefits through private insurance companies. Part D covers prescription drug insurance. Understanding the nuances of each part is essential for making informed decisions about your healthcare coverage. For instance, Part A typically has no monthly premium if you or your spouse paid Medicare taxes for a sufficient period, while Part B has a monthly premium based on income.

Part C plans often combine Parts A, B, and D, offering additional benefits like vision and dental coverage, but the specifics vary widely by plan. Part D requires a monthly premium and often a deductible before coverage begins.

Situations Where Medigap is Beneficial

Medigap, also known as Medicare Supplement Insurance, is private insurance that helps pay some of the healthcare costs that Medicare doesn’t cover. This is particularly helpful in situations where out-of-pocket expenses could be substantial, such as high deductibles, co-pays, or coinsurance. For example, if you have a chronic illness requiring frequent medical attention, Medigap can significantly reduce your financial burden.

Similarly, if you anticipate extensive travel, Medigap can offer broader coverage outside your local area, supplementing Medicare’s limitations in certain situations. Medigap plans are standardized (A through N), so it’s easier to compare plans from different companies.

Factors to Consider When Choosing a Medicare Advantage Plan or a Supplemental Plan

Choosing between a Medicare Advantage plan and a Medigap plan requires careful consideration of your individual needs and circumstances. Factors such as your health status, preferred doctors, budget, and desired level of coverage all play a crucial role in this decision. For example, if you have a complex medical history and require frequent specialist visits, a Medicare Advantage plan with a robust network of providers might be preferable.

However, if you value the freedom to choose any doctor who accepts Medicare assignment, Medigap might be a better option. Analyzing the cost-benefit ratio of each option, including premiums, deductibles, co-pays, and out-of-pocket maximums, is crucial for making an informed choice. Furthermore, reviewing the specific coverage details for each plan, including what services are included and excluded, is vital.

Key Features and Differences Between Medicare Advantage and Medigap Plans

The following table summarizes the key features and differences between Medicare Advantage and Medigap plans:

| Feature | Medicare Advantage | Medigap |

|---|---|---|

| Type of Plan | Private insurance plan that contracts with Medicare | Private insurance that supplements original Medicare |

| Coverage | Often includes Parts A, B, and D; may include extra benefits | Helps pay for Medicare’s cost-sharing |

| Network | Usually requires using doctors and hospitals within the plan’s network | Can generally see any doctor who accepts Medicare assignment |

| Premiums | Monthly premiums vary widely | Monthly premiums vary by plan type and insurer |

| Out-of-Pocket Costs | Potentially lower with some plans, but can be high with others | Can help lower out-of-pocket costs, but still some costs may apply |

Long-Term Care and Its Financial Implications

Planning for retirement often focuses on immediate healthcare needs, but the potential for long-term care is a significant financial consideration that shouldn’t be overlooked. Long-term care refers to the ongoing assistance needed for individuals who can no longer fully care for themselves due to age, illness, or disability. Understanding the various options and their associated costs is crucial for effective financial planning.

Types of Long-Term Care Options

Long-term care encompasses a range of services designed to meet diverse needs and preferences. The primary options include home care, assisted living facilities, and nursing homes. Each provides a different level of care and support, with corresponding variations in cost.

Financial Burden of Long-Term Care

The financial burden of long-term care can be substantial, varying significantly depending on the chosen option, location, and the level of care required. Home care, while often the least expensive option initially, can become costly if extensive support is needed. Assisted living facilities provide a higher level of care and supervision, but come with considerably higher monthly fees. Nursing homes, providing the most intensive medical care, are generally the most expensive option, with daily costs potentially reaching several hundred dollars.

These costs can quickly deplete savings and assets, particularly if long-term care is needed for several years.

Strategies for Mitigating Long-Term Care Financial Risk

Several strategies can help mitigate the financial risks associated with long-term care. These include purchasing long-term care insurance, exploring government assistance programs like Medicaid, and carefully planning asset allocation to preserve resources. Long-term care insurance policies provide financial coverage for long-term care services, helping to protect assets. Medicaid, a government program, offers financial assistance for those who meet certain income and asset requirements.

Strategic asset planning, including the use of trusts and other financial tools, can help protect assets while still qualifying for government assistance. Furthermore, creating a comprehensive financial plan that incorporates long-term care costs is essential. This should include an assessment of potential needs, cost projections, and a detailed strategy for funding long-term care expenses.

Comparison of Long-Term Care Options

| Care Type | Average Cost (Annual Estimate) | Level of Care Provided | Financial Resources Needed |

|---|---|---|---|

| Home Care | $48,000 – $72,000+ | Assistance with daily tasks, personal care, medical monitoring (varies widely based on needs) | Significant savings, potential need for supplemental insurance or government assistance |

| Assisted Living | $50,000 – $100,000+ | 24/7 supervision, assistance with daily living, some medical services | Substantial savings, potential need for long-term care insurance or government assistance |

| Nursing Home | $100,000 – $200,000+ | 24/7 skilled medical care, rehabilitation services, intensive personal care | Extensive savings, long-term care insurance highly recommended, potential reliance on government assistance |

Note

Costs are estimates and vary significantly based on location, level of care, and other factors. These figures represent average annual costs and should not be considered definitive. Consult with financial and healthcare professionals for personalized cost projections.*

Successfully navigating the financial challenges of healthcare in retirement requires proactive planning and a comprehensive understanding of available resources. By carefully estimating future costs, developing a robust savings plan, and making informed choices regarding insurance and long-term care, retirees can significantly reduce financial anxieties and maintain a secure and comfortable retirement. Remember, thorough planning and informed decision-making are key to a financially secure and fulfilling retirement.

Popular Questions

What is the best way to estimate future healthcare costs?

Use online calculators, consult with financial advisors, and consider factors like your current health, family history, and projected inflation rates.

When should I start planning for healthcare costs in retirement?

Ideally, begin planning as early as possible, even in your 40s or 50s, to allow ample time for saving and investing.

Can I use my HSA funds for long-term care expenses?

While generally not directly for long-term care, HSAs can offset other medical costs, freeing up funds for long-term care expenses.

What are the differences between Medicare Advantage and Medigap?

Medicare Advantage (Part C) is an alternative to Original Medicare, while Medigap (supplemental insurance) helps cover out-of-pocket costs with Original Medicare.